Buying your first house is a decision that should not be taken lightly. I have been thinking about buying a home for some time and it is exciting! That being said, it is also important to consider all the details and how your life will change. Long before you ever see your first house there are things to consider and prepare. Getting your finances in order is the first step in buying your first house. You need to do this to make sure you are ready to buy a home based on your monthly expenses. You also need to make sure that a lender will lend you the money unless you are ballin’ like that and do not need a lender. Below are some things to check for to make sure you can make it to the next step.

Create a Spending Plan

Create a Spending Plan

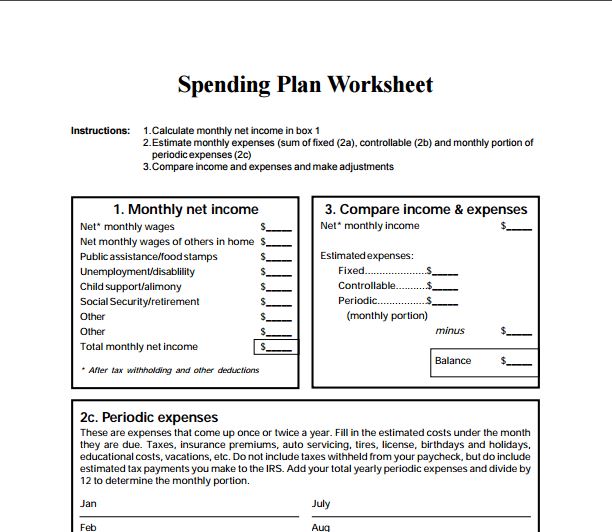

This helps prepare you financially to own a home by showing you fixed bills you have and can also help you determine adjustments to make so you can afford to buy a home. This plan should be based on your goals and will be different for every household based on what is important for them. For instance, for me, I know I can not give up my physical trainer as one of my goals is getting in shape. But, I can get rid of my makeup subscription and my DVD portion of Netflix. I have not used this in ages. Creating a spending plan can also help you find holes in your budget like my Netflix subscription. Below is the order you should do this in.

Gather a month of pay stubs, recent bills (credit cards, car payment, student loans, utility bills, rent, cable TV, etc) and your bank statements.

Gather a month of pay stubs, recent bills (credit cards, car payment, student loans, utility bills, rent, cable TV, etc) and your bank statements.- Determine gross income and net income. Gross is the monthly income before taxes and health insurance deductions. We want to use your net income for this. Lenders will use your gross income.

- Do not include any income that is not for sure! No overtime, commissions, bonuses or sporadic work.

- Next, add all the bills you are billed every month without any change in the payments. These are fixed expenses. Deduct the total from your net income.

- Periodic expenses should be deducted next. These are any bills that do not occur every month like your car registration.

- Controllable or flexible expenses are bills you have some control over including cable, internet, food, clothing, hair care, and entertainment. These should be deducted next. This is the area you should take a really hard look to determine if you can decrease any expenses.

- Consider the money you will take from your income to put in your savings account. Having a healthy savings account when you own a home is also important.

If the balance at the end of this exercise is $0 or negative, you may not be ready to buy a home. Here is a spending plan worksheet to help you with this exercise.

Pay Down Your Debt

Pay Down Your Debt

Lenders will not lend to you if you have judgments or items in collections. Or maybe your debt ratio is off. Lenders like to see a debt ratio of around 30%. You may need to pay down some credit cards. If you need to find space in your budget to pay down the debt, start a three-month spending journal that will track every penny you spend. Find the holes in your budget that you can avoid by taking an honest look at how you spend. Every bit you can pay towards your debt will help you reach your goals.

Save! Save! Save!

Save! Save! Save!

Now that you have evaluated your spending you can see how you spend your money. You will need to have money for closing costs and down payment. If you do not have enough savings to accommodate this, go back into your spending plan and work in a more aggressive saving plan if possible. This will help you to reach your home ownership goals quicker!

Find Financial Help

Find Financial Help

If this is intimidating to you, find counsel that can help you prepare for the next step. These are not all the same. Ensure you use a non-profit or HUD-approved to get the best service and assistance.

- Visit a financial counselor

- Use a Non-profit consumer credit counseling agency

- Seek budget counseling or pre-purchase housing counseling services from a HUD-approved organizations

- Know the difference between a debt-management plan and a debt-consolidation plan

Once you have put your finances in order you are ready to move onto the next step, which will be finding the right people to work with and getting pre-qualified. I bet you were ready to schedule the moving truck, but not quite yet! This was the step that took the longest for me. I worked hard for a year to get my finances and debt ratio in a place that would set me up for success.

What was the most interesting thing you found in your spending plan? Did you find budget holes like I did? Tell us in the comments!