As tax season comes to an end in a few weeks, some of you may wonder what do I do with all these tax documents? You definitely want to store them just in case of an audit or if you simply need to refer back at any documents. Here are some tips on storing tax documents:

Storage File Boxes

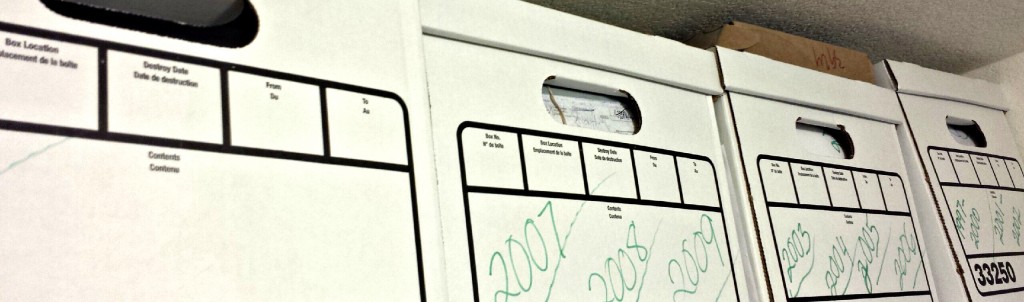

Even though some consider this an old-school method, storing your tax documents in storage file drawers or boxes is still a common and effective method. Most experts say that you should store documents anywhere from 3-10 years back. You can organize the folders by:

- years

- months

- receipts

- tax returns

- unpaid bills

You don’t have to buy the fanciest filing cabinet to do this job; a small box with labeled folders inside will do the trick. An good example of organized folders in a box is in the picture on the right. Color coding and labeling each section will make it easier for you to review the tax documents in case you are audited.

Storage File Room

Once you have stored your documents in a box or filing cabinet you can make a storage file room out of a closet and place your boxes in there. If you feel like you need more room you can always rent out a small storage unit or even a locker-sized space. Find one near here!

Electronic Storage and Backup

Electronic Storage and Backup

Some people prefer to complete their taxes online and would like to save the documents online as well. You can store your tax documents electronically by scanning them onto your computer, a CD, an external hard drive or a USB drive. Even if you have your tax documents stored safely away in storage boxes, it is always wise to electronically back them up. There is a plethora of online storage services including BackBlaze, Amazon S3, or Carbonite that you can look into as a back up for your tax documents.

Dead Weight

Here are a few things that usa.gov has recommended to throw away:

- cancelled checks

- multiple copies

- expired coupons

- salary statements (after checking W-2 forms)

No matter where you store your tax documents, be sure that they are in a secure area that only you and your immediate family know where they are. Leaving tax documents in the open or not disposing them properly could lead to identity theft.

Do you have some tips on storing tax documents? Leave them in a comment below!